Lucrative

Instant, easy solutions from anywhere. Apply with just one required document

Instant, easy solutions from anywhere. Apply with just one required document

A direct lender committed to responsibility and innovation. We keep your data confidential and help in hard times

Simple solutions from home, fast. Instant money in your account and flexible loan terms

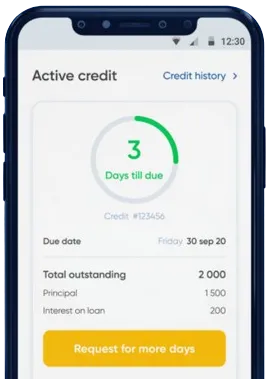

Submit an application via our app. Just fill out a simple form.

Stand by for our decision, usually delivered in just 15 minutes.

Receive the transfer, usually completed within one minute.

Submit an application via our app. Just fill out a simple form.

Download loan app

As financial technology evolves, loan apps have become a pivotal tool for managing personal finances, especially for receiving payments and loans swiftly. These apps offer a digital-first approach to borrowing and transactions, ensuring users can access financial services from anywhere at any time.

The convenience of loan apps has led to a surge in their popularity. A significant number of users have shifted from traditional banking methods to these digital solutions, attracted by their ease of use and rapid processing capabilities.

Loan app provides several distinct advantages over traditional financial services. The most notable is speed. Loan app processes transactions and loan requests in real-time, which means users can receive funds almost instantly. This is particularly beneficial in emergencies where immediate cash is crucial.

Another major benefit is accessibility. It is designed to be user-friendly, often requiring only a few clicks to complete transactions. This accessibility is enhanced by minimal eligibility requirements, making financial services available to a broader audience, including those with limited credit history.

Furthermore, Loan app offers competitive interest rates compared to conventional lenders, which can be particularly advantageous for long-term loans.

Security is a paramount concern in digital transactions. It incorporates advanced encryption and cybersecurity measures to protect user data and prevent fraud. Biometric authentication, like fingerprint and facial recognition, adds an extra layer of security, ensuring that financial transactions are both safe and private.

Loan app also adheres to strict regulatory standards that govern mobile and online banking, which helps build trust and reliability among users.

In addition to robust security protocols, this app features built-in tools for tracking spending and managing debts, empowering users with better financial literacy and control.

The trajectory of financial technology suggests that the use of loan apps will continue to grow. Innovations in AI and machine learning could make these platforms even more intuitive and secure, paving the way for more personalized financial services.

The integration of blockchain technology might also enhance the transparency and security of transactions, providing users with more control over their financial data.

Loan apps are reshaping the landscape of financial transactions with their speed, accessibility, and robust security features. As they evolve, these platforms are set to become an integral part of financial management, offering a seamless, secure, and efficient way to manage personal finances in the digital age. Whether for emergency funds, daily transactions, or managing debts, Loan app provides a compelling solution that aligns with the needs of modern consumers.

The Loan App is a mobile application that provides users with quick and easy access to financial services, including the ability to apply for and manage loans. It is designed to offer a convenient, secure, and fast way to handle financial transactions directly from your smartphone.

To apply for a loan, first download the Loan App from your device’s app store. Once installed, create an account, provide the necessary documentation for loan assessment, and follow the instructions to submit your loan application. The app typically notifies you of your approval status within a few minutes to a few hours.

The Loan App uses advanced encryption and security protocols to protect your data and financial transactions. It also implements biometric authentication features, such as fingerprint scanning and facial recognition, to ensure that access to your account is secure and private.

Fees can vary depending on the type of loan you choose and the terms set by the app. Common fees may include interest rates on the borrowed amount, processing fees, or late payment fees. Always review the fee structure in the app’s terms and conditions before applying for a loan.

If you encounter any issues with the Loan App, you can contact the customer support team directly through the app. You also can use live chat, email, and phone support, to assist you with any questions or problems.

The Loan App typically offers several repayment options to accommodate different financial situations. Users can choose from various payment plans, including monthly installments, bi-weekly payments, or lump sum repayments at the end of the loan period. Check the app’s settings or contact customer support for more details on customizing your repayment plan.